Quantitative Methods - Quantitative Methods Section 2

46. The covariance matrix for a portfolio is given below.

| Security | A | B |

| A | 480 | 140 |

| B | 140 | 600 |

The correlation for the portfolio is closest to:

- Option : A

- Explanation : Standard Deviation of A = √480= 21.91 Standard Deviation of B = √600 = 24.49 Corelation = 0.26

- Option : C

- Explanation : The total portfolio return is calculated as the weighted average return of the portfolio constituents. Portfolio return = (0.6 * 0.35) + (0.4 * 0.15) = 0.27 = 27.0%

49. The table below shows weighting and returns of different asset classes comprising a portfolio:

| Asset class | Asset allocation (weight) (%) | Asset class return (%) | Correlation with equities class (%) |

| Equities | 65 | 22 | 100 |

| Bonds | 30 | 8 | 30 |

| Cash and equivalents | 5 | 1 | 25 |

Based on the data given in the table, the portfolio return is closest

to:

to:

- Option : B

- Explanation : The portfolio return is the weighted mean return and is calculated as:0.65 * 22 + 0.30 * 8 + 0.05 * 1 = 16.75.

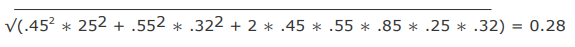

| Company | Expected Return | Standard Deviation |

| Gala Cement | 10% | 8% |

| Aqua Fertilizer | 17% | 20% |

The covariance between these two stocks is 0.005. Arvind is considering adding another stock, Teragon Foods. Teragon Foods has a correlation coefficient of 0.4 with the current portfolio. Which of the following statements is least accurate?

*/?>

*/?>

*/?>

*/?>